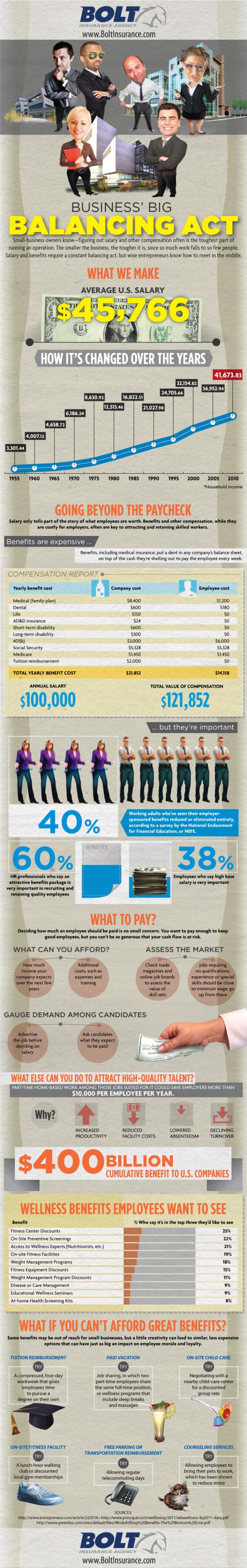

How Small Businesses Balance Salary and Compensation [infographic]

Is there a solution?

Infographic World created an infographic for Bolt Insurance Agency called Business’ Big Balance Act: Small Business Salary and Compensation that offers tips for entrepreneurs on how to balance salary and compensation. It even suggests alternatives to the two.

Key points:

- Benefits are key when attracting and retaining skilled workers.

- Benefits are expensive, but important.

- 40 percent of employees have seen their employee sponsored benefits reduced.

- When deciding what to pay for, employers should look at what they can afford, assess the market and gauge the demand among candidates.

- Offering part-time home-based work can save employers $10,000 per employee a year because it increases productivity, reduces facility costs, lowers absenteeism and declines turnover.

- Try alternative benefits such as on-site childcare, free parking and/or transportation reimbursement and on-site fitness facilities.

Check out the infographic for a visual on meeting skilled employees and compensation demands in the middle.