Matching Salary and Home-Ownership Expectations

Hence, any misconceptions about the cost of housing will result in misconceptions about the salary’s clout.

On the recruiter side, before feeling guilty or proud —or simply neutral—about the salary negotiated for a job candidate, it is important to ask whether the salary can meet expected housing needs and obligations, especially those related to home ownership.

In fact, you may want to discuss the proposed salary in the context of perceived housing costs. This may be especially desirable if the candidate has overestimated them, e.g., by not considering renting out rooms or a basement to a tenant, or by not factoring in the long-term savings and investment opportunities to be realized by locking in historically low interest rates.

You may also want to discuss the salary/housing-cost nexus in the opposite case, in which the costs have been underestimated. For example, the candidate may have overlooked the commuting costs associated with living farther from the office in a “cheaper” home (but with substantial commuting costs), when the prospective employer would prefer better proximity.

This would help ensure that the job is a good financial match for the candidate, as well as a good employer-employee and skills-challenge match.

Your role as a recruiter may involve suggesting ways to reduce those costs, e.g., by (not) commuting to an urban center from a seemingly cheaper suburban home, if the city, as well as the downtown job, is new. Similarly, the possibility of renting an apartment rather than purchasing a house or condo might be broached.

Dream, Delusion, or Disillusionment?

Nonetheless, you would like to imagine that hiring someone will help him or her live their American Dream (or its Canadian, Kiwi, etc., equivalent)—a dream that traditionally has dangled visions of home ownership. One service you can provide job candidates is a reality check on the reasonableness of that dream.

The following is a checklist of relevant considerations and clarifications that can be discussed in realistically matching a candidate’s salary and home-ownership expectations:

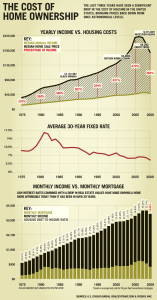

Home prices are not the same as home ownership costs: Even though the visualeconomics.creditloan.com chart displayed (with permission) here juxtaposes “the cost of home ownership” with “median home sale price”, home-ownership costs and home prices are otherwise clearly not the same. They are different, even if only because the cost of a home includes interest on the mortgage principal, maintenance, repairs, taxes and essential expenditures such as home energy.

Moreover, a higher-priced home may, in the long run, be cheaper as a cost than one with a lower sticker-price. One reason is that purchasing a higher-priced home with a low-interest mortgage may be better than having a higher-interest mortgage on a lower-priced home. In some instances and for this reason, the “cheaper” home may end up being more expensive.

For example, dramatically decreasing mortgage rates since 1980 (shown in the chart) have offset (as well as spurred) the higher home prices. From a purely mathematical point of view, these can be two counterbalancing considerations—high price and low interest rates. Therefore, a home price/income ratio may neither be cause for concern, gloom and doom, if the interest rate is low enough, nor proof of a disturbing trend toward unaffordability.

Hence, a higher-priced home doesn’t necessarily entail a higher ownership cost than a lower-priced house financed at a higher rate of interest, or when expenses such as higher maintenance, commuting or associated vehicular expenses are factored in for the lower-priced home.

Moreover, the wisdom of a purchase at any price crucially depends on home-price trends. A time-limited struggle with a mortgage can, of course, pay off big-time with a sale in a hot market.

These kinds of considerations can be very important and instructive to prospective employees changing homes to take the prospective job, and can include suggestions to investigate overlooked costs, local price trends and their underlying drivers.

Given that local and regional price differences can be huge, alerting a candidate to the prevailing local market can be a valuable service. For example, “thanks” to the 2008 meltdown, by 2009, in the U.S., the ostensible financial burden had dropped from a peak of 473% of mean annual household income ( “MAHI”, hereafter) to 373%.

However, this is the U.S. macroeconomic trend, reflecting plummeting real estate values caused, in great measure, by the subprime-mortgage market collapse.

In Canada, where very conservative banking practices prevented bank subprime exposure, and in particular, in Vancouver, the stats have been very different: According to doctorhousingbubble.com, the “average detached home price” in Vancouver, now the second least-affordable city in the world (Hong Kong being #1), was, in February 2012, $1,235,244, or 14 times MAHI.

However, a Vancouver Sun January 2012 article reported that median home price of $678,000 in the third quarter was 10.6 times its median pretax household income of $63,800 ( the 10.6-14 range perhaps reflecting differences among the statistical “mean”, “median” and “mode” as averages).

Even Vancouver condos, at more than $500,000, as mean or median, are comparatively costlier than U.S. detached homes, at 760% of MAHI.

Awareness of such substantial price/income ratio differences can be crucial for expat candidates pondering an overseas posting.

Menno van Driel, a British Columbia Sunshine Coast agent with Royal LePage, commenting on the subprime-induced downturn in U.S. prices, said, “England and Spain went through a bit of that too, but nothing like the US. The rest of the Western world hasn’t seen property value drops, so the charts would be completely different anywhere else.”

Accordingly, due diligence is required by any candidate inclined to factor home ownership into the expat job-offer equation. As a local recruiter in that overseas venue, you may be able to help.

“Median annual income” is total household income, which, historically, has had evolving implications for affordability:Normally, average annual incomes are household incomes—all household members over 18, irrespective of whether they are related. If the candidate is concerned about the adequacy of the offered salary or wanting to compare his prospective income with the MAHI used to calculate home affordability, (s)he and the recruiter may want to get a bigger demographic picture of the candidate’s financial circumstances and the housing/job market, in order to fine-tune the salary offer, where such wiggle-room exists.

Is there a spouse, partner or other stable co-tenant who can share the expense? Or is this a struggling family whose combined incomes, which, even if sufficient to finance a new home in the short term, may be vulnerable to a loss of one income, e.g., through foreseeable or unexpected maternity leave?

Taking these circumstances into account can help both the candidate and recruiter frame as realistic and fair a salary package as possible.

Buying, paying for and owning a home are not the same thing:If the candidate is concerned about home affordability within the proposed salary, it can be useful to note the obvious differences among buying, paying for and owning a home. In some instances, the main challenge may be buying the home, rather than paying for it, if, for example, there is a basement that can be rented out as a suite, but only after the down-payment is scraped together. This can be helpful to note when making mortgage payments is more of a concern to the candidate than the down-payment.

If, on the other hand, the concern is about being able to afford eventual clear-title ownership, with no interest in ever selling what is seen as the perfect home, the focus shifts from short-term, upfront, initial-salary supported investment in the home to long-term income stability and growth.

For the candidate concerned about such income growth and stability, it can be very useful to outline the income growth prospects and stability with the company—particularly if the career income growth-curve with the company is steep, despite what may be a comparatively lower initial salary.

Addressing the Climates of Home-Ownership Hope and Fear: the Lessons of History

As the discussion of double-income households implies, any partial reassurance that things have not gotten more difficult or worse based on lower interest rates and the relative historical flat-line stability of median annual income will be illusory to the extent that the earlier data is likely to have comprised more single-earner households than the more recent stats.

The point here is that part of the conversation between employer and candidate, and about salary and housing (mis)matches, should be about whether, in a historical context, the dream is as attainable as ever, or whether, if changes in the economic times require changes in expectations and adaptive tactics.

Encourage the candidate to do the math—including the household demographic math—and to be neither spooked nor enticed by high or low home-prices without calculating the full home-ownership costs, including not only the interest payments, but also the opportunity costs, e.g., alternative investments or renting instead of owning.

If the candidate is concerned about the salary at prevailing home prices and interest rates, it can, as recommended above, be helpful to mention the possibility of renting out the basement to a tenant, if it is or can be a self-contained suite.

If you are convinced that you can and should provide this kind of guidance, you may score a home run with candidates and clients….

…if not stimulate a run on or from homes.