Retiring at 80

MULTIPLE COST-BENEFIT BREAK-EVEN POINTS/Image: Michael Moffa

A recent Wells Fargo survey of 1,500 Americans between the ages of 20 and 70 reveals that 20% of them believe that they will “need to work until at least age 80” to live comfortably into retirement . Scary? No, you say, since it’s only 20% and hopefully not you–even though almost all of the rest say they expect to work into their retirement years. Well, today it’s “only” 20% and not you, but what if the economy doesn’t improve, or worse, worsens?

And since when would anyone imagine 1/5th of the population expecting to retire only about five months before they are, from current U.S. government calculations of at-birth life expectancy, likely to die—and then only if female, given a life expectancy of 80.4 years for women, which is five years more than for men? After all, aren’t the retirement years supposed to be many “golden years” rather than a few short “golden months”?

Obvious and Subtle Implications

Consider the implications, both obvious and subtle, of such mass postponement of retirement. On the one hand, social security and pension plans might get a break, as could younger workers, both in terms of continuing contributions by geriatric workers to (rather than drains on) those programs and possibly delayed increases in average payroll taxes required to fund them. On the other hand, there’s the flipside of competition for jobs that would increase were grandparents to challenge their grandchildren for jobs. Then, of course, there are the company health plan implications of having substantial numbers of workers in their seventies on board. This much is obvious.

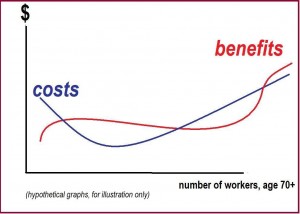

Less obvious is the cost-benefit, break-even equation that weighs the costs against the benefits to younger workers, companies and to the macro-economy of having such dramatic retirement postponement. That single equation would express the intersection of the cost and benefit curves of a steady increase in the numbers of 65- to 80-year-old employees. Alternatively, the costs and benefits to each of these three sectors can be graphed separately in order to calculate their respective break-even points. Complex though those single equations or the one mega-equation may be, they and it exist, even if not yet in the mind of any mathematician, accountant or nearly sentient computer.

At some point in that prodigious calculation, adding one more superannuated 80-year-old employee may strengthen (or weaken) one, two or all three legs of the economic tripod supported by the young, the companies and the macro-economy; yet, at some other (higher or lower) level of geriatric job entry, the impact of one more old(er) worker may generate a net cost (or benefit)—a line of reasoning that allows that the cost-benefit break-even level may be more than one point, e.g., graphs like a straight line intersecting a curve in two places, or two curves intersecting even more times, as do the income and expenditure curves in an illustration in the Dictionary of Health Economics by Alan Earl-Slatersimilar to the one shown above.

Your Takeaway Lessons

The first takeaway lesson here that it is probably a big mistake to accept the simplistic notion that somehow postponement of retirement until at death’s door would be categorically “good” or “bad” for the economy, the young or for companies (given that it will probably be bad for those postponing it out of perceived necessity).

The second lesson is that it may also be wrong to assume there is a single break-even point, with respect to the numbers of geriatric workers, at which “good” becomes “bad”, or vice versa. The actual situation may be much more complex than this, with two or more levels of such employment being neither good nor bad for the young, for companies or for the economy, i.e., break-even points at which costs and benefits are precisely balanced.

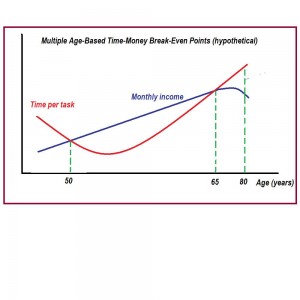

A third lesson is that you should generalize the first two: When doing whatever formal or informal calculations you may undertake to determine your break-even point in whatever context, don’t forget that there will be only one such point, if and only if the component lines are straight, i.e., linear. Otherwise there will be more than one way to break even.

MULTIPLE TIME-INCOME BREAK-EVEN POINTS/Image: Michael Moffa

For example, if you take the adage “time is money” seriously and literally, and map your time per job task as a cost against your income as a benefit, and if your time costs per task decrease over time because of a factor such as greater efficiency (before increasing again for reasons such as failing health), you will have at least two break-even points to choose from as career goals (assuming time and money as the only determining cost-benefit variables). Similarly, if those surveyed in the Wells Fargo study revisited their priorities and considered trading “comforts” for time (assuming that less time per task means more free time in general), they might find multiple break-even points, or even merely a shifted linear-model break-even point that would allow them to retire earlier, say, at 65.

If despite whatever rosy projections or wishful thinking currently color your expectations about the age at which you will retire, you someday face the prospect of contemplating your own break-even retirement points, you may find some comfort in the possibility that by juggling your own priorities and by having some non-linear inputs, you may have more than one shot at breaking even and taking that permanent break from work.

…Maybe even before you are or when the calendar says you would have been 80.