With First Crypto ETF, a More Accessible Way to Buy Cryptocurrencies

A friend of mine has made some serious money in Bitcoin. I have to admit, I’m a little jealous of him. Here I sit, watching the cryptocurrency market pass me by, while my friend is seeing excellent results – as are many other people.

Why don’t I just follow my friend’s lead and put some money into cryptocurrency?

The answer is simple: I find the whole thing overwhelming and imposing. Bitcoin is up, then it’s down, then it’s up again. And what are all these other coins? Ethereum? Monero? How are they doing? Which ones are sound investments, and which are sure to wipe me out?

The team behind First Crypto ETF knows all too well how confusing the world of cryptocurrency can be, which is why they’re launching the first exchange-traded fund for cryptocurrencies.

Ten Currencies in One Token

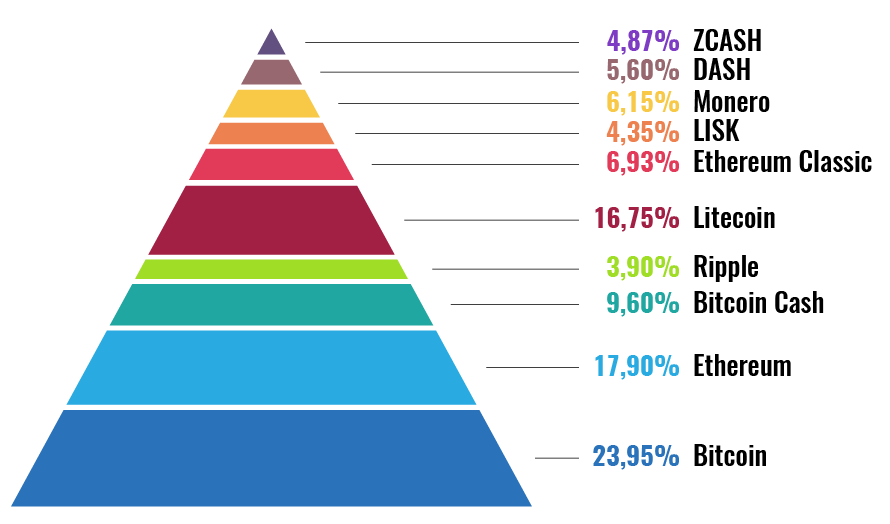

First Crypto ETF is taking a new approach to cryptocurrency, one that allows people to easily enter the market. The company has created a portfolio of 10 top-traded, high-demand currencies. When a person buys a single token from First Crypto ETF, what they’re really buying is a basket of cryptocurrencies. Each portfolio contains:

By offering people the ability to purchase multiple types of coins in a single transaction, First Crypto ETF makes cryptocurrency more accessible to the average person. You don’t have to spend hours analyzing the markets or fretting over which currency is right for you. You only have to monitor the price of one token. The company’s token may also be attractive to seasoned crypto enthusiasts looking for an easier way to diversify their holdings.

The portfolio model also takes some of the risk out of the equation – which is good news, considering the wild fluctuations in Bitcoin recently. Because each of First Crypto ETF’s tokens is backed by 10 other coins, changes in a single currency won’t spell disaster for holders. The value stays relatively balanced as some coins go down, some stay stable, and some rise.

Transparency, Transparency, Transparency

First Crypto ETF is committed to full transparency in its operations. Blockchain technology itself promotes a level of constant security, as buyers can use it to keep track of their portfolios’ movements and statuses. First Crypto ETF also plans to be audited by a Big Four company in the near future to verify the status of its portfolios.

Distributed tokens will be kept in cold storage to avoid breaches and attacks, and the team is also developing a hot/cold wallet system for the safe storage and management of cryptocurrencies.

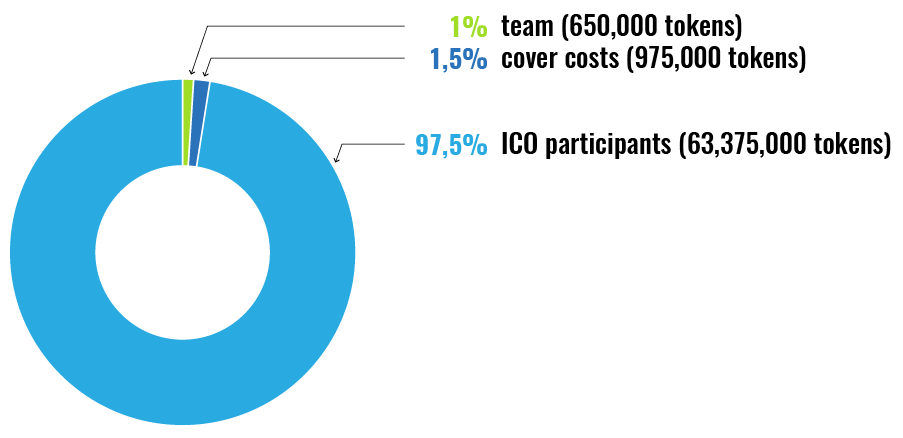

At the level of the business itself, First Crypto ETF keeps client assets separate from the company’s activities. As the below graphic makes clear, the team will only keep a small number of tokens, with the vast majority going to ICO participants:

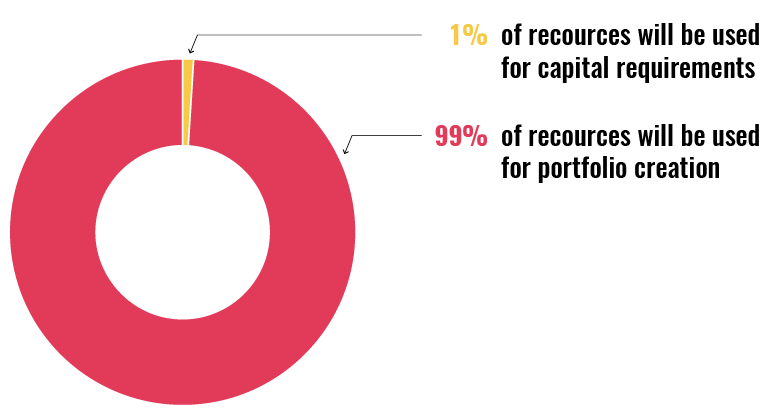

As for resource distribution, 99 percent will go to portfolio creation:

The Team Behind First Crypto ETF

The people powering First Crypto ETF are seasoned finance veterans. Vacuumlabs, the development team responsible for First Crypto ETF’s platform, has previously worked on Cardano coin, biometric security, booking portals, and banking projects, such as for Raiffeisen Bank.

First Crypto ETF will also be participating in the upcoming Money20/20 Asia conference.

First Crypto ETF Press Release: http://bit.ly/2ojfrGp

For more information on First Crypto ETF, visit www.firstcryptoetf.com.

Recruiter.com regularly features reviews, articles, and press releases from leading companies and may list clients with which we have a commercial relationship. Please treat this article for general informational purposes only and not as financial or legal advice.